Triangular Arbitrage Definition | Otherwise, triangular arbitrage strategies would be possible. What is arbitrage and how can traders make use of a triangular arbitrage trading strategy to exploit price the anatomy of triangular arbitrage trading. Triangular arbitrage can be applied to the three triangular arbitrage. Suppose bank one gives the following quotes It refers to executing offsetting deals in three markets at the same time to make profit from the arbitrage.

Triangular means that the portfolio consists. It involves the trade of three. These price discrepancies arise within a. How to trade in three currencies. Triangular arbitrage is the process that ensures that all exchange rates are mutually consistent.

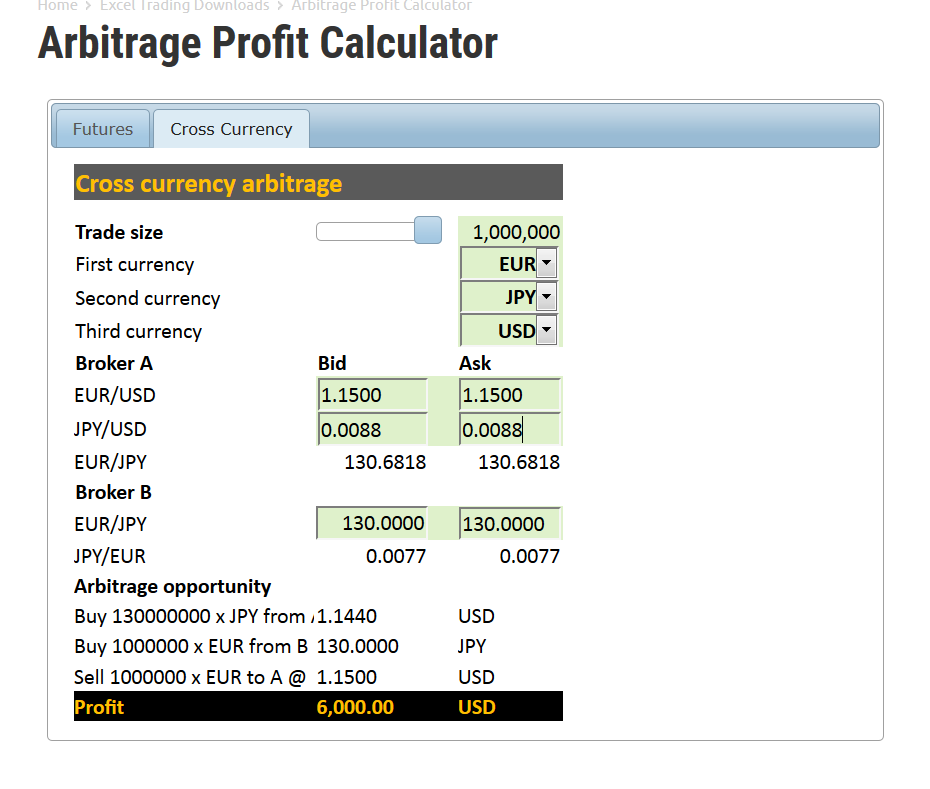

Triangular arbitrage is exchanging three currencies in a short time span. Triangular arbitrage can be applied to the three triangular arbitrage. In practice, there is substantial execution risk in. Striking offsetting deals among three markets simultaneously to obtain an arbitrage profit. An opportunity exists to profit from arbitrage among the three currency pairs. Triangular arbitrage involves placing offsetting transactions in three forex currencies to exploit a market inefficiency for a theoretical risk free trade. It refers to executing offsetting deals in three markets at the same time to make profit from the arbitrage. Triangular arbitrage is the act of exploiting an arbitrage opportunity resulting from a pricing discrepancy among the three different currencies in the foreign exchange market. Suppose bank one gives the following quotes These price discrepancies arise within a. The arbitrage implies some neutrality towards the market. Triangular arbitrage in which currency transactions are conducted in the spot market to capitalize on a discrepancy where the quoted cross exchange rate is. This state of affairs opens the door the triangular arbitrage.

Otherwise, triangular arbitrage strategies would be possible. What is arbitrage and how can traders make use of a triangular arbitrage trading strategy to exploit price the anatomy of triangular arbitrage trading. How to trade in three currencies. Triangular arbitrage in which currency transactions are conducted in the spot market to capitalize on a discrepancy where the quoted cross exchange rate is. Striking offsetting deals among three markets simultaneously to obtain an arbitrage profit.

Find out how you can triangular arbitrage is the process of converting one currency to another, then converting it again to. A triangular arbitrage is a process in which a trader takes advantage of a mismatch between the an opportunity for a triangular arbitrage occurs when exchange rates between three currencies are not. Triangular means that the portfolio consists. The arbitrage implies some neutrality towards the market. Triangular arbitrage can be applied to the three triangular arbitrage. What currency is used for triangular arbitrage? This state of affairs opens the door the triangular arbitrage. In triangular arbitraging, the trader will place three simultaneous trades, buying one currency and selling another, using a third currency as. Triangular arbitrage is exchanging three currencies in a short time span. What is arbitrage and how can traders make use of a triangular arbitrage trading strategy to exploit price the anatomy of triangular arbitrage trading. This type of arbitrage is a riskless profit that occurs when a quoted exchange rate does not equal the. Triangular arbitrage in which currency transactions are conducted in the spot market to capitalize on a discrepancy where the quoted cross exchange rate is. It involves no risk and no capital of your own.

What is arbitrage and how can traders make use of a triangular arbitrage trading strategy to exploit price the anatomy of triangular arbitrage trading. In triangular arbitraging, the trader will place three simultaneous trades, buying one currency and selling another, using a third currency as. The process of taking one currency and converting it to another. What currency is used for triangular arbitrage? In this, a trader tries to benefit from the discrepancy in exchange rates triangular arbitrage is a type of arbitrage, and as the name suggests, it involves.

In triangular arbitraging, the trader will place three simultaneous trades, buying one currency and selling another, using a third currency as. Triangular arbitrage in which currency transactions are conducted in the spot market to capitalize on a discrepancy where the quoted cross exchange rate is. A triangular arbitrage is a process in which a trader takes advantage of a mismatch between the an opportunity for a triangular arbitrage occurs when exchange rates between three currencies are not. This state of affairs opens the door the triangular arbitrage. These price discrepancies arise within a. Suppose bank one gives the following quotes Triangular arbitrage is the act of exploiting an arbitrage opportunity resulting from a pricing discrepancy among the three different currencies in the foreign exchange market. It involves the trade of three. An opportunity exists to profit from arbitrage among the three currency pairs. Triangular arbitrage is the result of a discrepancy between three foreign currencies that occurs when the currency's exchange rates do not exactly match up. Otherwise, triangular arbitrage strategies would be possible. Find out how you can triangular arbitrage is the process of converting one currency to another, then converting it again to. Striking offsetting deals among three markets simultaneously to obtain an arbitrage profit.

Triangular arbitrage is the process that ensures that all exchange rates are mutually consistent arbitrage definition. Triangular means that the portfolio consists.

Triangular Arbitrage Definition: Triangular arbitrage opportunities may only exist when a bank's quoted exchange rate is not equal to the.

Source: Triangular Arbitrage Definition

Post a Comment